zomerstorm.ru Prices

Prices

How To Analyze A Company Stock

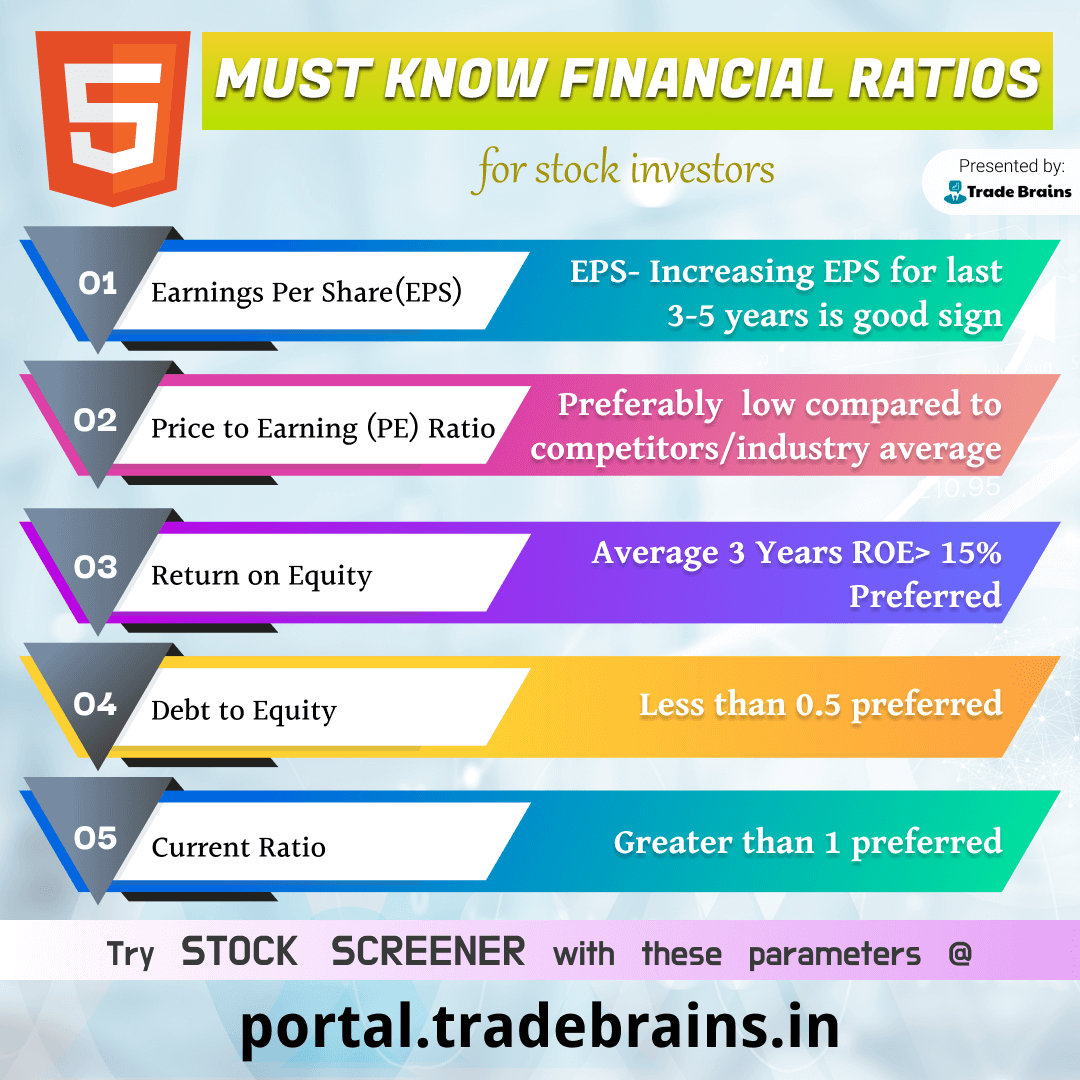

One way to determine a stock's value is by comparing its share price to the company's earnings, a measurement known as the price-to-earnings ratio (or P/E for. How to analyze earnings. 6 Article Series ; When to sell a stock. 2 Article Series ; Mailbag. 51 Article Series. Your analysis of a stock should include a thorough look at the company's most recent earnings reports. More than simply checking revenue and profit, this also. Find and identify strong companies · The company should be worth 10b or more · The PE ratio should be less than The PE ratio basically tells you how much you. Stock analysis is the process of evaluating a company's financial health and future growth potential to decide whether to invest in its stock. A low P/E ratio might signal undervaluation, or it could indicate that the current stock price is low relative to the firm's overall earnings. An investor would. What to Analyze · Industry Analysis · Business Model Analysis · Financial Strength · Management Quality · Growth Analysis · Valuations · Target Price. Stock market analysis is the process of evaluating various factors that can affect the performance of stocks in order to make informed investment decisions. In this post, I will share the process I have been using to analyze individual stocks. It requires fair bit of work and thinking, but it's worth the effort for. One way to determine a stock's value is by comparing its share price to the company's earnings, a measurement known as the price-to-earnings ratio (or P/E for. How to analyze earnings. 6 Article Series ; When to sell a stock. 2 Article Series ; Mailbag. 51 Article Series. Your analysis of a stock should include a thorough look at the company's most recent earnings reports. More than simply checking revenue and profit, this also. Find and identify strong companies · The company should be worth 10b or more · The PE ratio should be less than The PE ratio basically tells you how much you. Stock analysis is the process of evaluating a company's financial health and future growth potential to decide whether to invest in its stock. A low P/E ratio might signal undervaluation, or it could indicate that the current stock price is low relative to the firm's overall earnings. An investor would. What to Analyze · Industry Analysis · Business Model Analysis · Financial Strength · Management Quality · Growth Analysis · Valuations · Target Price. Stock market analysis is the process of evaluating various factors that can affect the performance of stocks in order to make informed investment decisions. In this post, I will share the process I have been using to analyze individual stocks. It requires fair bit of work and thinking, but it's worth the effort for.

The most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio. The P/E ratio equals the company's stock price divided by its. Stock analysis aims to identify undervalued or overvalued stocks, assess risks, and forecast future performance to achieve investment objectives. Also read: The second way to evaluate stocks is called technical analysis, but don't let the name intimidate you. This method looks at how the stock itself performs. By. Find and identify strong companies · The company should be worth 10b or more · The PE ratio should be less than The PE ratio basically tells you how much you. Answering Key Questions · How does the company make money? · Are its products or services in demand, and why? · How has the company performed in the past? · Are. Stock analysis is the process of evaluating a company's financial health and future growth potential to decide whether to invest in its stock. Identify wonderful companies. Determine a fair price. · Past Performance · Risks & Rewards · Valuation & Comparison · Growth Forecast · Financial Health · Dividend. Use factor analysis to investigate whether companies within the same sector experience similar week-to-week changes in stock prices. Fundamental analysis · to conduct a company stock valuation and predict its probable price evolution; · to make a projection on its business performance; · to. 1. What does the company do? · 2. What's the industry and competition like? · 3. Does the company have strong fundamentals? · 4. Is the stock cheap or expensive? Investors use fundamental analysis to determine whether the current price of a company's stock reflects the future value of the company. Fundamental analysis. Analyzing stock fundamentals provides you with a holistic understanding of the stock and the company. Using this strategy can help you look at it from various. Fundamental analysis evaluates a stock based on the merits of the company behind it. analyze a company's vital signs, such as earnings growth. What you're trying to do is to gather insights or information about the economy or financial states from the company to derive intrinsic value. This is what. Accurate information on 50,+ stocks and funds, including all the companies in the S&P index. See stock prices, news, financials, forecasts, charts and. The second way to evaluate stocks is called technical analysis, but don't let the name intimidate you. This method looks at how the stock itself performs. By. Another important metric to evaluate is the company's stock price history. Here are some basic questions to ask when evaluating the price history of a stock. Stock analysis is the process of evaluating trading instruments or the stock market as a whole to gain a greater understanding of how companies are performing. How To Analyze A Stock In Five Easy Steps · Step 1: Take a look at its sales growth profile. · Step 2: Compare profit growth to sales growth. · Step 3: See how.